The Three Bubble Problem: AI, Crypto, and Debt Explained - Twitter Explodes

2|0 comments

Alright, let's talk AI. Not the hype, not the promises, but the actual numbers. Because frankly, the narrative being pushed feels… off. We're hearing "investment super-cycle," "major revolution," all the buzzwords. But as someone who spent years sifting through financial statements, I'm trained to ask: where's the *there* there?

The core of the current AI frenzy revolves around infrastructure – specifically, data centers. We're talking about a projected $3 trillion spend through 2028, according to Morgan Stanley analysts. But here's the rub: companies' cash flows are only covering about half of that. Meaning, they're borrowing. A lot.

And it's not just straightforward debt. We're seeing the resurgence of "special purpose vehicles" (SPVs), a financial tool that, shall we say, has a checkered past. (Enron, anyone?) The structure is complex, but the gist is this: a separate entity is created to build a data center, financed by debt. A Big Tech firm becomes an "anchor tenant," promising payments that theoretically cover the debt. The debt doesn't show up on the Big Tech firm's balance sheet. It's financial engineering at its finest, or most concerning, depending on your perspective.

This reminds me of the dot-com bubble, where fiber-optic cables were being laid at a furious pace, financed by debt, for a future that never fully materialized. Analyst Gil Luria put it bluntly: "If we get to the point after spending hundreds of billions of dollars on data centers that we don't need a few years from now, then we're talking about another financial crisis." Some analysts believe that Here's why concerns about an AI bubble are bigger than ever are indeed bigger than ever.

AI's "Circular Economy": Real Demand or Just Subsidies?

The Circular Economy of AI Hype Then there's the issue of circular investments. A prime example: Nvidia pumping $100 billion into OpenAI to bankroll data centers, which OpenAI then fills with Nvidia's chips. It's like subsidizing your own demand. The question becomes: is this real demand, or artificially inflated demand? This raises a critical point: what if the returns don't materialize? OpenAI lost over $11.5 billion last quarter alone. (Yes, *lost*.) And they're planning on spending even *more* in the coming years. Where's that revenue going to come from? A growing body of research suggests most firms aren't seeing significant bottom-line impact from chatbots. And only a tiny fraction of people – about 3%, according to one analysis – are actually paying for AI services. Personal Aside: I've looked at hundreds of these growth projections. And this reliance on *future* revenue streams to justify current spending always makes me nervous.AI's $1.6 Trillion Question: Private Credit's Risky Bet?

The Private Credit Wild Card A significant portion of this AI buildout is being financed by private credit, a sector that's grown to over $1.6 trillion in assets under management. These are non-banks, operating with less regulation than traditional banks. Blue Owl, for example, a major player in this space, has nearly $300 billion under management. But even within this seemingly bulletproof trade, there are cracks. Blue Owl, in the aftermath of a merger of two of its private credit funds, is blocking redemptions in a way that will automatically give those investors 20 percent losses. Think about that for a second. If a traditional bank did that, it would be a bank run. And here's a detail that's easy to overlook: AI firms are extending their depreciation schedules for GPUs. In other words, they're claiming these chips will last longer than they probably will. This leads to overstated revenues, as companies have to purchase far more GPUs than they're admitting publicly. Some of the smaller companies are even using loans backed by their GPUs to purchase *more* GPUs. It's a house of cards built on assumptions. Reality Check: The Stranded Asset Problem Ultimately, the AI boom hinges on a bet: that the demand for AI will continue to grow exponentially, justifying the massive infrastructure investments being made today. But what if that demand plateaus? What if the Chinese AI models, which are reportedly more efficient, pull ahead? What happens to all those data centers, all those GPUs, all that debt? We could be looking at a wave of stranded assets – buildings and equipment that become obsolete before they're paid off. And who will be left holding the bag? Potentially, ordinary retail investors with 401(k) plans. That's the part that truly worries me. A Data-Driven Dose of Skepticism-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

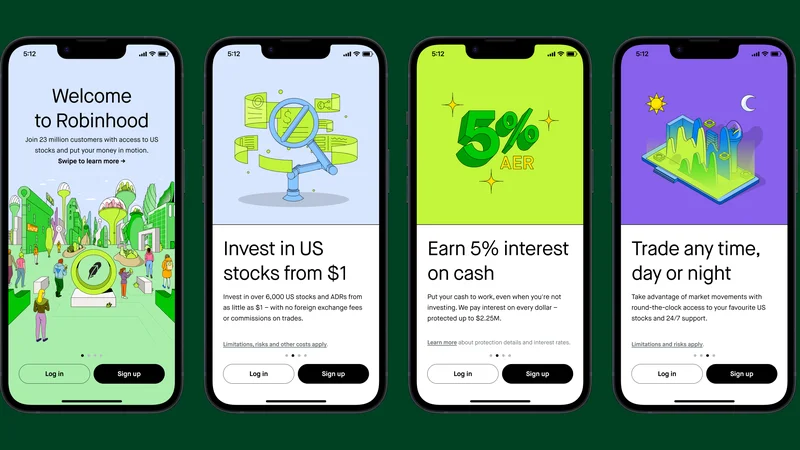

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- DeFi Post-Crash: Why the Investor Story Is Wrong (Thoughts?)

- Bitcoin's $80K Risk: The Key Level to Watch - Thoughts?

- Why Crypto's Chaos Hides Its Biggest Opportunity (Reddit's Take)

- DeFi Tokens Post-October Crash: What's Really Happening & The 2025 Outlook

- Why Altcoin Season Is Here: Three Unstoppable Forces - Debate Intensifies

- Benny Blanco's Pink Pineapple: Seriously? - Pineapple-Mania Unleashed!

- The Pink Pineapple: The Data Behind the Viral Sensation - Reactions: Obsessed!

- The Unseen Shift: Why Bitcoin Indicators Failed - Debate Intensifies

- The Three Bubble Problem: AI, Crypto, and Debt Explained - Twitter Explodes

- Why Crypto's $15B Expiry Won't Matter - Discussed!

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (7)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- kimberly clark (5)

- uae (5)

- uber stock (5)