Why Crypto's $15B Expiry Won't Matter - Discussed!

2|0 comments

October's $16B Crypto Options: Max Pain Ahead?

The Looming Options Expiry Alright, let's cut to the chase. Over $16 billion in Bitcoin and Ethereum options are set to expire on October 31, 2025. That's a hefty chunk of change riding on where these two cryptos land. The expiry is slated to hit Deribit at 8:00 UTC. Bitcoin accounts for the lion's share, $13.28 billion worth, representing 145,482 contracts. Ethereum lags behind, but still commands a respectable $1.73 billion, or 574,208 contracts. Now, here's where it gets interesting. The "max pain" point for Bitcoin—the price at which the most option holders will feel the burn—is sitting pretty at $100,000. Currently, Bitcoin is trading around $91,389. For Ethereum, the max pain is $3,400, while it's trading closer to $3,014. Historically, the price tends to gravitate toward the max pain as expiry nears. (Think of it like a magnet, but for financial regret.) The put-to-call ratios offer another layer of insight. Bitcoin's ratio is 0.54, with 94,539 call contracts open versus 50,943 put contracts. Ethereum shows a similar skew, with a 0.48 ratio – 387,010 calls versus 187,198 puts. What does this tell us? The market is leaning bullish, but not overwhelmingly so. The slight skew towards calls suggests more people are betting on an upward move, but there's still a significant contingent hedging their bets with puts.Decoding the Chaos: $16B Expiry Edition

Decoding Market Sentiment Traders? They're all over the map. Some are taking a cautious approach, hedging their positions as we approach the expiry. Others are doubling down on year-end bullish predictions. We even saw some traders who were long on puts (betting the price would fall) taking profits when Bitcoin dipped into the $81,000 to $82,000 range. This behavior suggests a belief that the downside is limited, at least for now. Then there's the curious case of the call condor. Apparently, there’s a large options structure targeting $100k+ by December 26, with an ideal settlement range between $106,000 and $112,000. The payoff ratio is a juicy 10:1. (That's the kind of return that makes even the most seasoned investor raise an eyebrow.) But someone, somewhere, has been actively capping the upside, using overwriting strategies on the December 100k and January 100-105k calls. Why? Are they trying to suppress volatility? Or are they simply profiting from the premiums, content with a smaller, but more certain, gain? Details on why the decision was made remain scarce, but the impact is clear. This expiry is bigger than last week’s $6 billion event—due to the monthly rollover of October contracts. Now, I've looked at hundreds of these expiry events, and this particular setup is unusual. We've already seen a 35% drop from $126,000 prior to the expiry date, which is a bit unnerving. One thing that I find genuinely puzzling is the range of predictions and bets. It's like looking at two completely different datasets. As BeInCrypto notes in their coverage of a similar event, Bitcoin & Ethereum Brace for $15 Billion November Options Expiry - BeInCrypto, these large expiries can have a significant impact on market volatility. The Bulls Might Be Disappointed So, what's the real takeaway here? The $16 billion options expiry is a significant event, no doubt. But the market is far from unified in its expectations. While the put-call ratios and the existence of the call condor suggest a bullish sentiment, the active capping of upside potential raises questions. Are we headed for max pain? Maybe. But more likely, we're headed for a period of increased volatility and uncertainty. Anyone who thinks this is a sure thing is probably going to be in for a rude awakening. This Could Get Messy

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

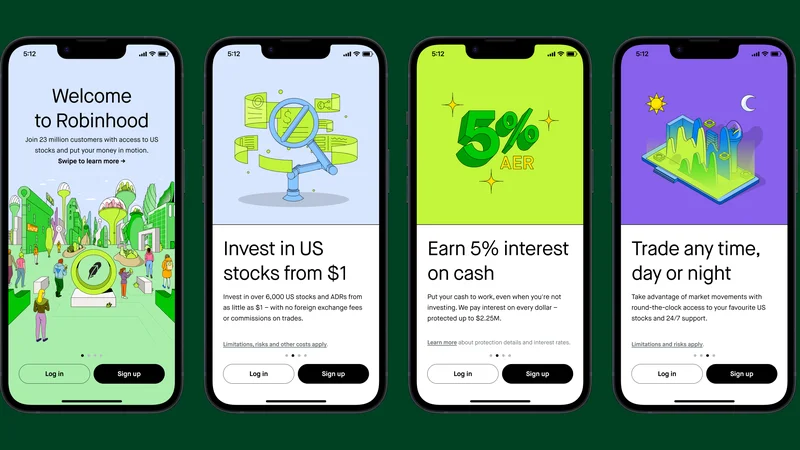

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- DeFi Post-Crash: Why the Investor Story Is Wrong (Thoughts?)

- Bitcoin's $80K Risk: The Key Level to Watch - Thoughts?

- Why Crypto's Chaos Hides Its Biggest Opportunity (Reddit's Take)

- DeFi Tokens Post-October Crash: What's Really Happening & The 2025 Outlook

- Why Altcoin Season Is Here: Three Unstoppable Forces - Debate Intensifies

- Benny Blanco's Pink Pineapple: Seriously? - Pineapple-Mania Unleashed!

- The Pink Pineapple: The Data Behind the Viral Sensation - Reactions: Obsessed!

- The Unseen Shift: Why Bitcoin Indicators Failed - Debate Intensifies

- The Three Bubble Problem: AI, Crypto, and Debt Explained - Twitter Explodes

- Why Crypto's $15B Expiry Won't Matter - Discussed!

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (7)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- kimberly clark (5)

- uae (5)

- uber stock (5)