Why Altcoin Season Is Here: Three Unstoppable Forces - Debate Intensifies

2|0 comments

Alright, buckle up, everyone! If you're even casually following the crypto space, you've probably heard the whispers: Altcoin season is officially upon us. And let me tell you, this isn't just another blip on the radar; this is potentially a paradigm shift, a fundamental change in how we perceive and interact with digital assets.

Bitcoin's Taking a Nap; Altcoins Are Ready to Party!

Altcoin Season is Here The data's pretty clear. Bitcoin, while still the king, is taking a breather. Its dominance is down (almost 6%!), and the Altcoin Season Index is surging. We're talking about a market where, recently, a whopping 75% of the top 50 coins have been outperforming Bitcoin. That's not just a trend; that's a tectonic shift. What does it mean? Well, think of it like this: Bitcoin built the highway, but now the off-ramps are opening up, leading to all sorts of exciting new destinations.Altcoin Frenzy: A Perfect Storm of Opportunity?

The Perfect Storm So, what's fueling this altcoin frenzy? It's not just one thing; it's a confluence of factors, a perfect storm of innovation, investment, and regulatory clarity. Let's break it down: First, the Fed is hinting at interest rate cuts. Now, I know, economics can sound dry, but think of it like this: lower interest rates are like loosening the purse strings of the entire financial world. Suddenly, there's more money floating around, and investors are more willing to take risks on…well, on things like altcoins! As Kyle Chasse, founder of MV Global, put it, a bigger-than-expected rate cut could trigger “a significant rally in crypto since no one is truly expecting it.” Second, we're seeing the rise of crypto treasury companies. These are firms that are essentially leveraging themselves to the hilt to buy up crypto. Sean Dawson, head of research at Derive, describes it as a “reflexive flywheel for price action.” They issue debt, buy crypto, and the price goes up, attracting more investment. It’s a bit like a snowball rolling downhill, gathering momentum as it goes. The question is, will the snowball keep rolling, or will it eventually melt? And perhaps most importantly, the regulatory landscape is starting to clear up. Paul Atkins, former Chairman of the SEC, has even declared that “crypto’s time has come!” Can you believe it? The SEC, once seen as a major obstacle, is now actively working on creating a regulatory framework for crypto. They're reviewing over 90 exchange-traded products, including altcoin applications for cryptocurrencies like Solana and XRP. This isn't just about compliance; it's about legitimacy. It's about bringing crypto into the mainstream. But let's not get ahead of ourselves. As Annabelle Huang, founder of Altius, points out, this momentum will only last for "high quality altcoins with sustainable revenue." The Wild West days of just slapping together a token and hoping it moons are over. This is about real projects, real utility, and real value. Look at what’s already happening. Pudgy Penguins, Solana, Jupiter – these aren't just random names; they're examples of altcoins that are surging because they're tied to specific catalysts: partnerships with established companies, large institutional investments, and seamless wallet integrations. It's about real-world adoption, plain and simple. Altcoin Season: Pudgy, Solana, Jupiter Rally on CatalystsAltcoin Season: A Financial Revolution Unfolding?

The Ripple Effect Now, what does this mean for us, for you? Well, imagine a world where decentralized finance is no longer a niche concept but a mainstream reality. Imagine a world where artists and creators can directly monetize their work without relying on intermediaries. Imagine a world where financial inclusion is a global reality, not just a buzzword. That's the promise of altcoin season. It's not just about making a quick buck (although, let's be honest, that's part of it). It's about building a more equitable, more transparent, and more innovative financial system. Of course, with great power comes great responsibility. We need to be mindful of the risks involved. We need to be vigilant against scams and fraud. And we need to ensure that this technology is used for good, not for ill. The ethical considerations here are paramount. But honestly, when I first started looking at the convergence of these trends, I just felt a surge of… well, excitement. This is the kind of moment that reminds me why I got into this field in the first place. The potential here is truly staggering. We're talking about a financial revolution, and we're all witnessing it unfold in real-time. Wolfgang Münchau, a columnist for DL News, hit the nail on the head when he said, "This is the world for which crypto was created — a world in which governments believe it is expedient to tolerate higher inflation and debt." Higher inflation? That's practically rocket fuel for crypto. Why higher inflation is a gift to crypto But there's a catch, isn't there always? Münchau also warns that stablecoins, while seemingly stable, are still tied to the underlying asset – the US dollar. And if the dollar itself becomes unstable? Well, that's a question we need to seriously consider.Altcoin Season: A Wild Ride to Financial Freedom

The Dawn of a New Financial Era So, what's the real story? Altcoin season isn't just a fleeting trend; it's a sign of a fundamental shift in the financial landscape. It's about innovation, disruption, and the democratization of finance. It's a wild ride, no doubt, but it's a ride worth taking. Just remember to buckle up, do your research, and always be mindful of the risks involved. The future is being built right now, and it's being built on the blockchain.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

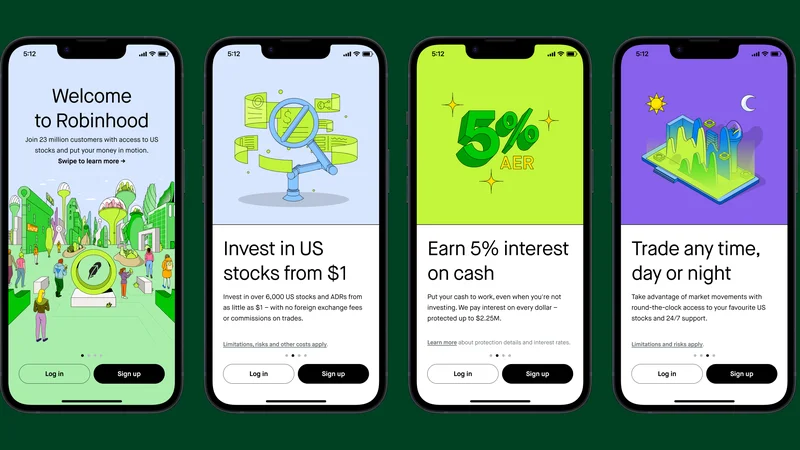

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- DeFi Post-Crash: Why the Investor Story Is Wrong (Thoughts?)

- Bitcoin's $80K Risk: The Key Level to Watch - Thoughts?

- Why Crypto's Chaos Hides Its Biggest Opportunity (Reddit's Take)

- DeFi Tokens Post-October Crash: What's Really Happening & The 2025 Outlook

- Why Altcoin Season Is Here: Three Unstoppable Forces - Debate Intensifies

- Benny Blanco's Pink Pineapple: Seriously? - Pineapple-Mania Unleashed!

- The Pink Pineapple: The Data Behind the Viral Sensation - Reactions: Obsessed!

- The Unseen Shift: Why Bitcoin Indicators Failed - Debate Intensifies

- The Three Bubble Problem: AI, Crypto, and Debt Explained - Twitter Explodes

- Why Crypto's $15B Expiry Won't Matter - Discussed!

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (7)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- kimberly clark (5)

- uae (5)

- uber stock (5)