DeFi Tokens Post-October Crash: What's Really Happening & The 2025 Outlook

2|0 comments

html DeFi "Recovery": Don't Swallow the PR Kool-Aid

DeFi's "Recovery"? More Like Rearranging Deck Chairs on the Titanic Okay, so we're supposed to believe DeFi is "recovering" after the October crypto crash? Give me a break. These analysts can spin it however they want, but the numbers don't lie: most DeFi tokens are still underwater. Down 37% *this quarter*? That ain't exactly a ringing endorsement. For more insights into DeFi token performance and investor behavior after the October crash, see DeFi Token Performance & Investor Trends Post-October Crash. They say investors are flocking to "safer" names with buybacks. HYPE and CAKE are supposedly doing better. So, what, buying back your own tokens is now a sign of strength? That's like a company bragging about using its cash to prop up its stock price instead of, you know, actually innovating. It's a short-term fix, not a long-term strategy. And then there's this gem: lending and yield names are "stickier" in a downturn. Translation: people are too scared to pull their money out, so they're just leaving it there to rot. Hey, you know what's also sticky? Gum on your shoe. Doesn't mean you want it there. The Solana Hype Train: Still Chugging Along? Speaking of hype, let's talk about Solana. Consistently achieves 1,000+ transactions per second? Near-constant uptime? Sounds great on paper, but I've seen "near-constant" turn into "intermittent outages" real quick. They're patting themselves on the back for low transaction fees, like $0.00025 per transaction. Okay, cool. But if nobody's actually *using* the network for anything worthwhile, what's the point? It's like having a super-fast highway to nowhere. And what's with the constant comparisons to Ethereum? "Solana's efficiency makes it attractive for NFT and microtransaction-heavy applications." Translation: "We're not as good as Ethereum, but maybe we can steal some of their lunch money." Solana folks talk about "ecosystem growth" and "institutional participation." But let's be real, most of that is just VCs throwing money at anything that moves. How much of it is *real* adoption, by *real* users, doing *real* things? I bet it's a lot less than they want you to think.Crypto's "Next Big Thing": More Like "Next Big Scam"?

New Shiny Coins: A Recipe for Disaster And now we get to the really fun part: new crypto coins. "Bitcoin Hyper" merging Bitcoin security with Solana speed? Please. It's the crypto equivalent of putting a Ferrari engine in a Yugo. "Maxi Doge" targeting gym bros who trade 1000x leverage? I can't even... Is that really the future we want? A bunch of juiced-up bros gambling their life savings on meme coins? "Ethena," a synthetic dollar protocol. Delta-neutral hedging? Short perpetual positions? It all sounds very impressive, but it's just a fancy way of saying "we're playing with fire." The delta-neutral model works... until it doesn't. And when it doesn't, it's gonna be ugly. The $28.86M raised shows demand, but there's no testnet, no public code, and anonymous developers. The 43% staking APY is unsustainable, and with fierce Bitcoin Layer 2 competitors already out there, I believe, this is speculation on promises until they ship actual working infrastructure. So, What's the Real Story? Look, I'm not saying crypto is dead. But this whole "DeFi recovery" narrative? It's mostly smoke and mirrors. A few tokens might pump, a few new projects might gain traction, but the underlying problems are still there: centralization, volatility, and a whole lot of scams. Maybe I'm just being cynical, but I don't see any real reason to be optimistic. Not yet, anyway. Just Another Pump and Dump-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

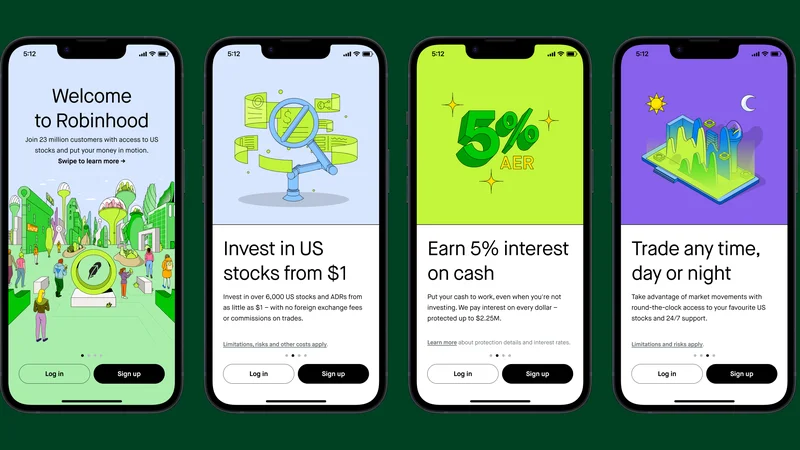

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- DeFi Post-Crash: Why the Investor Story Is Wrong (Thoughts?)

- Bitcoin's $80K Risk: The Key Level to Watch - Thoughts?

- Why Crypto's Chaos Hides Its Biggest Opportunity (Reddit's Take)

- DeFi Tokens Post-October Crash: What's Really Happening & The 2025 Outlook

- Why Altcoin Season Is Here: Three Unstoppable Forces - Debate Intensifies

- Benny Blanco's Pink Pineapple: Seriously? - Pineapple-Mania Unleashed!

- The Pink Pineapple: The Data Behind the Viral Sensation - Reactions: Obsessed!

- The Unseen Shift: Why Bitcoin Indicators Failed - Debate Intensifies

- The Three Bubble Problem: AI, Crypto, and Debt Explained - Twitter Explodes

- Why Crypto's $15B Expiry Won't Matter - Discussed!

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (7)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- kimberly clark (5)

- uae (5)

- uber stock (5)