DeFi Post-Crash: The 2025 Reality Check - Investor Reactions Inside

2|0 comments

Julian Vance: Binance's Crystal Ball or Just Another Crypto Casino?

The crypto world is buzzing, as usual, with predictions about the next batch of tokens to grace Binance's listing. Bitcoin Hyper (HYPER), Maxi Doge (MAXI), and a handful of others are currently leading the speculation, fueled by their presale momentum. But let’s pump the brakes for a moment and dissect what’s really going on here. Are these listings a sign of Binance's strategic vision, or just another roll of the dice in the crypto casino?

Presale Millions: Fool's Gold or Future Fortune?

The Presale Frenzy: A Data-Driven Delusion? The narrative is always the same: a new token emerges, promises the moon, and launches a presale. Investors, gripped by FOMO (fear of missing out), pile in, hoping for a quick buck once the token hits a major exchange. We're seeing it now with Bitcoin Hyper, which has raked in over $28.64 million in its presale. Maxi Doge and Best Wallet Token are also riding this wave, collectively pulling in over $10 million in the past month. But here's the rub: presale success is a terrible indicator of long-term value. It's marketing hype at its finest. The real test comes after the listing, when the token faces the cold, hard reality of the open market. How many of these presale darlings will actually deliver on their promises? (My gut feeling is not many.) Binance, of course, knows this. Their official listing requirements, published back in 2021, stress factors like a minimum viable product, a proven team, and real adoption. But those requirements are four years old now. The space has changed. Meme-utility hybrids, multi-chain interoperability, and "real-world/DeFi utility" are the buzzwords now. Are Binance's listing decisions keeping pace, or are they simply chasing trends? 10 New Upcoming Binance Listings to Watch in November 2025 - CoinspeakerThe Binance Bump: A Blessing or a Curse?

The Binance Bump: A Predictable Pump and Dump? There's no denying the "Binance bump." Historically, tokens listed on Binance have gained an average of 41% within 24 hours of the announcement. This is the lure that draws in the presale investors, the promise of instant gratification. But what happens after the pump? The data suggests a less rosy picture. Many of these tokens, after the initial surge, tend to bleed value over the long term. Consider the recent listings in September and October 2025: Yield Basis (YB), Enso (ENSO), Euler (EUL), Walrus (WAL), Aster (ASTER), Linea (LINEA), Pump.fun (PUMP), Ethena USDe (USDe), Open Ledger (OPEN), Somnia (SOMI), and World Liberty Financial (WLFI). How many of these are you still hearing about? How many are actually building something of lasting value? (I'll give you a hint: the answer is not many.) And this is the part of the report that I find genuinely puzzling. Binance claims they don't make money from the listing process. They released a clarifying tweet about it on October 15, 2025. But if that's the case, what's their incentive to list these often-questionable projects? Is it simply to drive traffic to their platform? To cater to the whims of their 275 million registered users? Or is there something else at play here? One possible explanation: Binance Alpha. This feature in the Binance wallet app offers early access to web3 projects and their tokens. Each "showcase" runs for 24 hours, highlighting projects in batches. Is this a way for Binance to test the waters, to gauge community interest before committing to a full listing? It’s an interesting experiment, no doubt, but it also raises questions about transparency and due diligence.Thiel's Nvidia Exit: A Warning Sign for Crypto?

Thiel's Exit: A Canary in the Coal Mine? While everyone is busy chasing the next Binance listing, let's not ignore the broader market context. Bitcoin, after failing to hold $100,000, recently tested $90,000. The probability of a Federal Reserve rate cut in December has plummeted. And, perhaps most tellingly, Peter Thiel recently exited all of his Nvidia positions. Thiel's move is particularly concerning. He's a smart guy, and he's been around the block. His decision to bail on Nvidia suggests he sees an overheated market, ripe for a correction. If that's the case, the "Binance bump" might not be enough to save these newly listed tokens from a broader market downturn. The Illusion of Predictability The truth is, predicting which tokens Binance will list is a fool's errand. Following CZ on social media or joining a listing alert service might give you a slight edge, but it's ultimately a guessing game. The crypto market is inherently unpredictable, driven by hype, speculation, and the occasional dose of genuine innovation. Binance listings are just one piece of the puzzle, and they shouldn't be treated as a guaranteed path to riches. A Reality Check The data paints a clear picture: the Binance listing game is a high-risk, high-reward proposition. Presale success is often a mirage, the "Binance bump" is fleeting, and the long-term prospects of many listed tokens are dubious at best. Investors should approach these listings with caution, do their own research (DYOR), and avoid getting caught up in the hype. Otherwise, they're just gambling.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

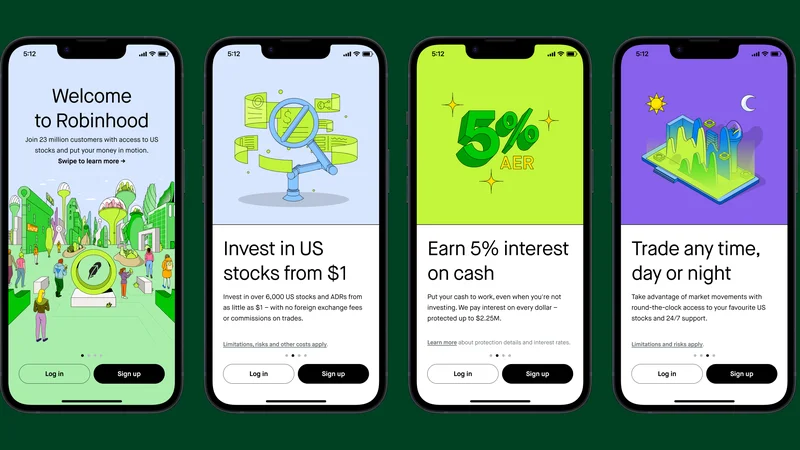

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- DeFi Post-Crash: Why the Investor Story Is Wrong (Thoughts?)

- Bitcoin's $80K Risk: The Key Level to Watch - Thoughts?

- Why Crypto's Chaos Hides Its Biggest Opportunity (Reddit's Take)

- DeFi Tokens Post-October Crash: What's Really Happening & The 2025 Outlook

- Why Altcoin Season Is Here: Three Unstoppable Forces - Debate Intensifies

- Benny Blanco's Pink Pineapple: Seriously? - Pineapple-Mania Unleashed!

- The Pink Pineapple: The Data Behind the Viral Sensation - Reactions: Obsessed!

- The Unseen Shift: Why Bitcoin Indicators Failed - Debate Intensifies

- The Three Bubble Problem: AI, Crypto, and Debt Explained - Twitter Explodes

- Why Crypto's $15B Expiry Won't Matter - Discussed!

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (7)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- kimberly clark (5)

- uae (5)

- uber stock (5)