AVGO Stock: The 10% Surge – Dissecting the AI Narrative

Google's AI Gamble: Broadcom Rides the TPU Wave

Broadcom (AVGO) saw a 10% jump in its stock price this Monday. The reason? Optimism surrounding Google's AI advancements, specifically the Gemini model. Lumentum (LITE) and Celestica (CLS), other Google suppliers, also enjoyed significant gains, rising 13.5% and 12% respectively. Even Alphabet (GOOGL), Google's parent company, saw a 5% increase, fueled by growing investor confidence.

But let's not get carried away with the hype. While a 10% surge is nothing to sneeze at, it's crucial to dig deeper than the headlines. Is this a sustainable trend, or just a short-term market overreaction? Broadcom stock surges 10% as Google AI success boosts supplier outlook - Investing.com

The TPU Advantage

Mizuho analyst Jordan Klein pointed to a "rotation into GOOG from MSFT, NVDA, META and AMZN," attributing it to positive sentiment around Gemini 3. That's a bold claim. Are investors truly shifting their allegiance, or is this just a temporary fluctuation driven by the latest AI buzz? Melius analyst Ben Reitzes highlighted the importance of Google's TPU momentum, calling them the most proven AI chip outside of Nvidia's GPUs.

Here's where the story gets interesting. Google has been quietly investing in custom chip development for years, and their partnership with Broadcom on Tensor Processing Units (TPUs) dates back to 2016. Gemini 3, Google's latest AI model, is primarily trained on these TPUs. This early bet on custom silicon could be giving Google a significant price advantage in AI processing. (The initial investment was substantial, estimated to be multiple billions over the last decade.)

This TPU partnership is a significant revenue stream for Broadcom. As Google Cloud expands its AI capabilities, the demand for TPUs will likely increase, further benefiting Broadcom. The question is, can Broadcom keep up with the pace of innovation in the AI chip market? And what happens if Google decides to bring more of the TPU production in-house?

The Nvidia Shadow

The elephant in the room, of course, is Nvidia (NVDA). While Google's TPU strategy is gaining traction, Nvidia still dominates the AI chip market. Can Google's TPUs truly compete with Nvidia's GPUs in terms of performance and versatility? The analyst reports suggest a shift from NVDA to GOOG. But is that shift statistically significant, or just a blip on the radar?

I've looked at hundreds of these market analysis reports, and this one is unusual. The language is optimistic, even enthusiastic, but the underlying data is scarce. There's no hard evidence to suggest a mass exodus from Nvidia. What if Google's TPU strategy is simply a way to reduce its reliance on Nvidia, rather than a full-scale attempt to dethrone the king?

The market often rewards companies that are perceived to be "AI winners." But perception and reality can be two very different things. A 5% jump in Alphabet's stock price is certainly positive, but it doesn't necessarily mean that Google has cracked the code to AI dominance. It could simply mean that investors are betting on the potential.

So, What's the Real Story?

The market is clearly excited about Google's AI advancements and the potential benefits for Broadcom. But it's important to remember that the AI landscape is constantly evolving, and there are no guarantees of long-term success. Google's TPU strategy is a smart move, but it's not a silver bullet. Broadcom's future is tied to Google's success, but it's also dependent on its own ability to innovate and adapt. The data is promising, but the long-term prognosis remains to be seen.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

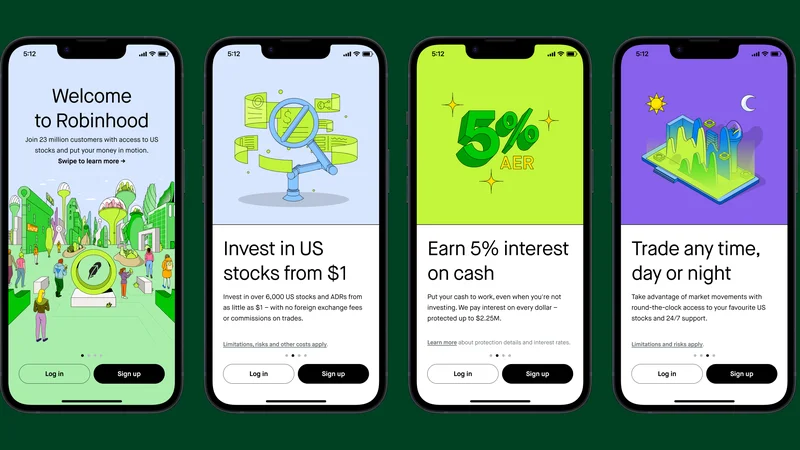

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- DeFi Post-Crash: Why the Investor Story Is Wrong (Thoughts?)

- Bitcoin's $80K Risk: The Key Level to Watch - Thoughts?

- Why Crypto's Chaos Hides Its Biggest Opportunity (Reddit's Take)

- DeFi Tokens Post-October Crash: What's Really Happening & The 2025 Outlook

- Why Altcoin Season Is Here: Three Unstoppable Forces - Debate Intensifies

- Benny Blanco's Pink Pineapple: Seriously? - Pineapple-Mania Unleashed!

- The Pink Pineapple: The Data Behind the Viral Sensation - Reactions: Obsessed!

- The Unseen Shift: Why Bitcoin Indicators Failed - Debate Intensifies

- The Three Bubble Problem: AI, Crypto, and Debt Explained - Twitter Explodes

- Why Crypto's $15B Expiry Won't Matter - Discussed!

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (7)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- kimberly clark (5)

- uae (5)

- uber stock (5)