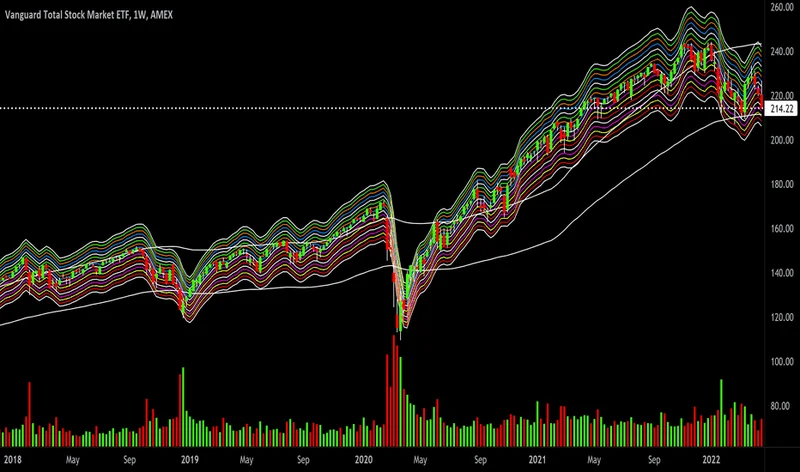

VTI Stock: Charting Its Course & Outpacing VOO

Generated Title: VTI ETF: Not Just a Basket, But a Launchpad to Tomorrow's Giants!

Okay, folks, let's talk VTI. The Vanguard Total Stock Market ETF. I know, I know, it sounds… well, vanilla. But trust me, this isn't your grandma's index fund. It's a launchpad. A silent engine driving us toward a future brimming with innovation. And the latest data points? They're practically screaming with potential.

You see articles talking about VTI's performance – up 13% year-to-date, a slight dip of 1.74% over the last five days. All true. But those are just numbers. The real story is what VTI represents. It's exposure to nearly the entire U.S. equity market. 3,488 stocks, to be precise! Think of it as a diversified bet on human ingenuity itself. It's not about picking winners; it's about enabling them.

The Unsung Hero of Innovation

Let’s zoom in on those top holdings for a moment. Nvidia (NVDA), Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Broadcom (AVGO). Familiar names, right? Powerhouses driving AI, cloud computing, and the next generation of consumer tech. But here’s the thing: VTI isn’t just passively holding these giants. It’s fueling them. By providing a steady stream of capital, VTI allows these companies to invest in research, development, and expansion. It’s a virtuous cycle of growth.

And it's not just the big names. VTI also holds smaller, more speculative companies with massive upside potential. FAT Bands (FAT), Jupiter Neurosciences (JUNS), Cibus (CBUS), NRX Pharmaceuticals (NRXP), Direct Digital Holdings (DRCT) – these are the names you might not know yet, but they could be the next Nvidia. They are the hidden potential of tomorrow.

Think of it like this: VTI is like the fertile soil in which these companies can take root and flourish. It's the ecosystem that allows innovation to thrive.

Now, I've seen the lukewarm takes. "VTI is just average," some say. "It's likely to perform in line with the broader market." And sure, the Smart Score of seven suggests exactly that. But I think that thinking is too limited. VTI’s broad exposure means you’re not just betting on the current market leaders. You’re betting on the future ones. You’re betting on the unknown breakthroughs that will reshape our world. What does this mean for us? Well, it means we're all stakeholders in the future. But more importantly, what could it mean for you?

Speaking of the future, consider Caterpillar (CAT). Up over 56% year-to-date! Who would have guessed a heavy-duty construction machinery company would be crushing the market? But it’s not just about bulldozers and excavators anymore. It’s about digital technologies, automation, and the infrastructure of tomorrow. VTI, by holding companies like Caterpillar, is quietly investing in the very foundations of our future cities and industries. These Dow Stocks Have Crushed the VOO and VTI in 2025—Here’s Where They’re Headed Next

And then there's Goldman Sachs (GS), up over 36% year-to-date. Some might say investment banks are relics of a bygone era, but Goldman's dealmaking momentum and resilience in the economy prove otherwise. They are the engine of capital allocation, directing funds to the most promising ventures. And VTI, by holding Goldman Sachs, is participating in that process.

Of course, with great power comes great responsibility. We need to ensure that these investments are directed towards ethical and sustainable ventures. We need to hold these companies accountable for their impact on society and the environment. It isn't just about profit; it's about progress.

And, if I am being honest, when I look at VTI I see a reflection of human potential. It's a reminder that we are all capable of creating a better future.

The Future is Being Built Now

VTI isn't just an ETF; it's a stake in the ground. It's a bet on human ingenuity, on innovation, and on the future itself. And that, my friends, is something worth getting excited about.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

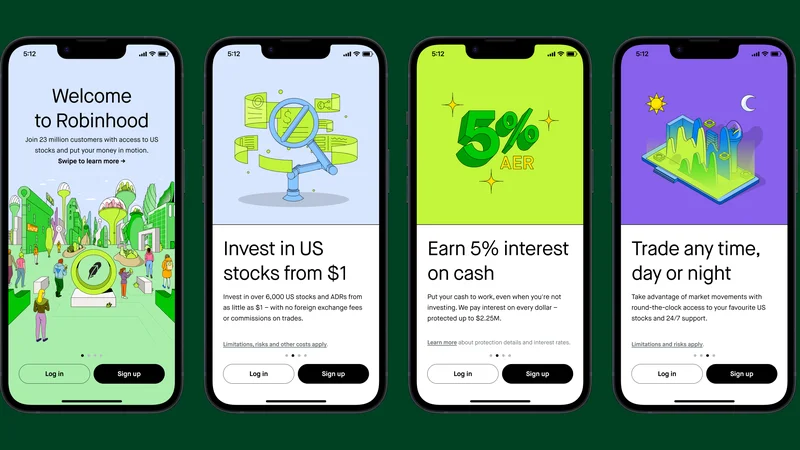

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- DeFi Post-Crash: Why the Investor Story Is Wrong (Thoughts?)

- Bitcoin's $80K Risk: The Key Level to Watch - Thoughts?

- Why Crypto's Chaos Hides Its Biggest Opportunity (Reddit's Take)

- DeFi Tokens Post-October Crash: What's Really Happening & The 2025 Outlook

- Why Altcoin Season Is Here: Three Unstoppable Forces - Debate Intensifies

- Benny Blanco's Pink Pineapple: Seriously? - Pineapple-Mania Unleashed!

- The Pink Pineapple: The Data Behind the Viral Sensation - Reactions: Obsessed!

- The Unseen Shift: Why Bitcoin Indicators Failed - Debate Intensifies

- The Three Bubble Problem: AI, Crypto, and Debt Explained - Twitter Explodes

- Why Crypto's $15B Expiry Won't Matter - Discussed!

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (7)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- kimberly clark (5)

- uae (5)

- uber stock (5)